rsu tax rate canada

At any rate RSUs are seen as. The taxable benefit is the difference.

Restricted Stock Units Jane Financial

ABC was trading at 12 and Sues employer again sold 23 shares and remitted the withholding tax to CRA.

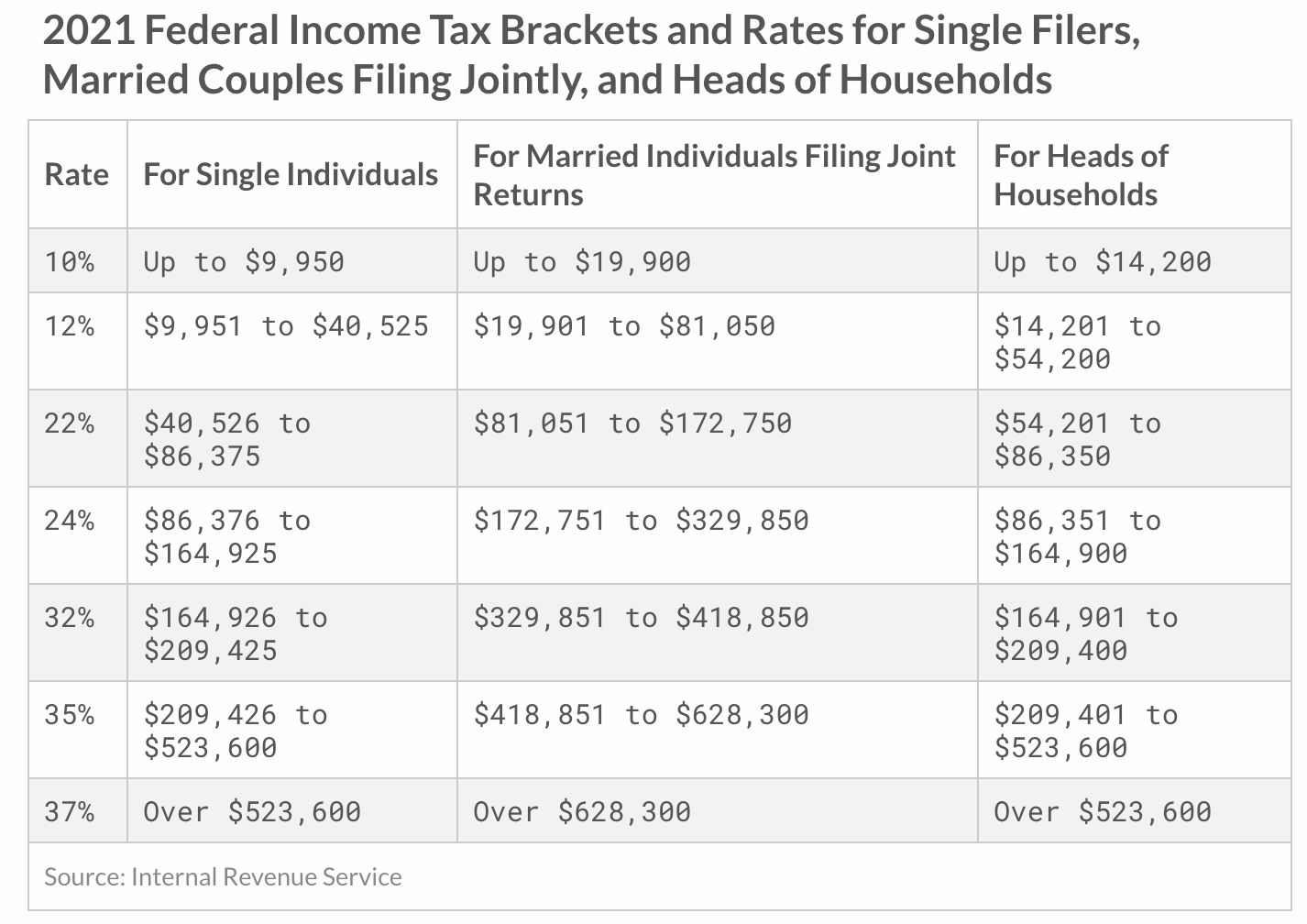

. The RSUs you get will be taxed about half de to it being income and when you sell. This benefit should be reported on the T4 slip issued by your employer. Taxes on federal income will be withhold from most companies at a flat rate of 22.

RSUs that are cash-settled or settled in cash or stock at the option of the employer are widely used in Canada. 613-751-6674 Chantal Baril Tel. Im curious how tech companies do tax deductions when granting RSUs in Canada.

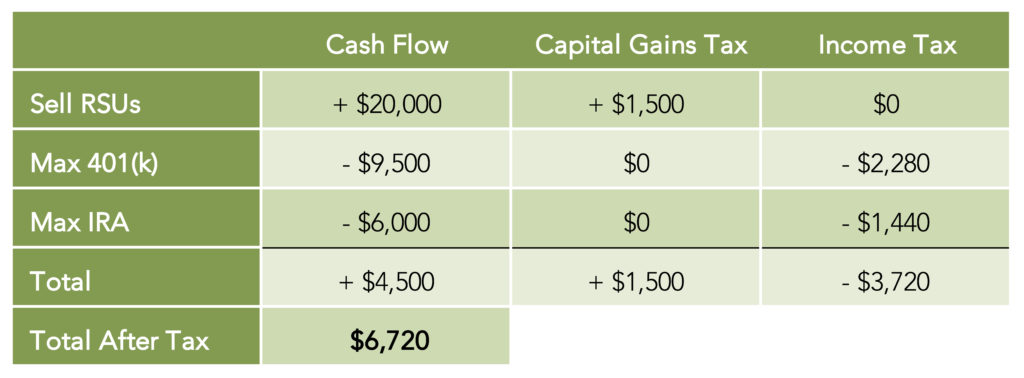

The taxable benefit is the. You can use the 2020 brackets. Restricted Stock Units RSUs Tax Calculator Apr 23 2019 0 Hope you had a chance to glance over at the official Restricted Stock Unit RSU Strategy.

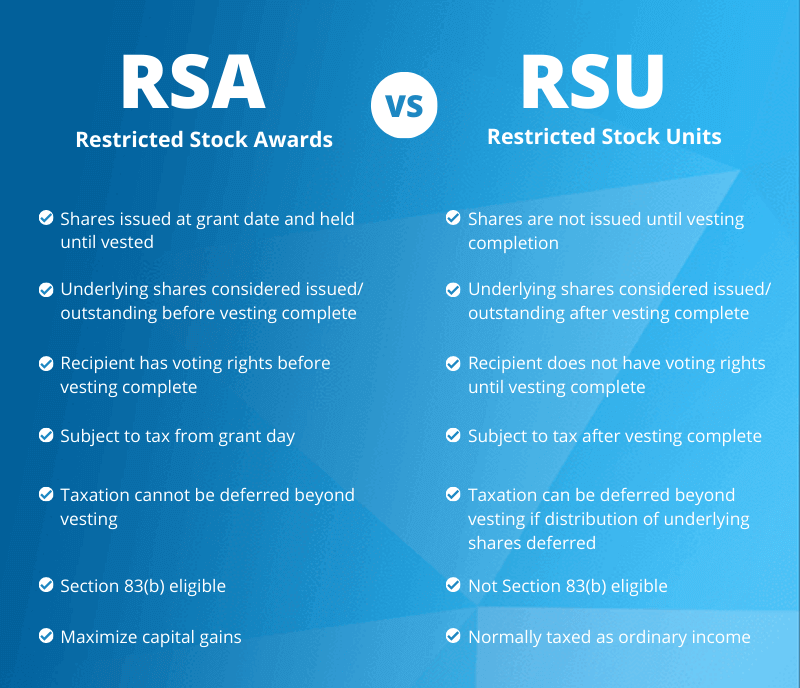

When you exercise your employee stock options a taxable benefit will be calculated. Those plans generally have tax consequences at the date of exercise or sale whereas restricted stock usually becomes taxable upon the completion of the vesting schedule. The units represent a.

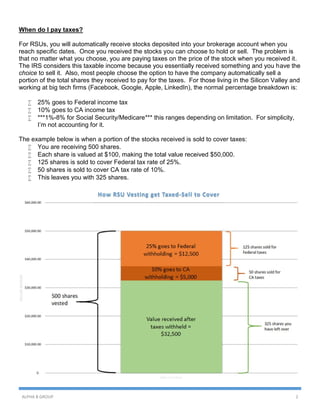

In both cases her employer included 500 and 600 in employment income and 230 and 276 in income tax deducted in Sues T4 for 2011 and 2012 respectively. Your vesting price is. Multiply the tax rate from 2 by the gross value of the RSUs that vested and subtract the amount that was already withheld by your employer.

Thats the income tax side of things. Canadian Tax Legal Alert CRA issues new views on RSU taxation in Canada April 21 2021 Contacts. For 2022 that rate is 22 on supplemental wages up to 1 million and 37 for wages in excess of 1 million.

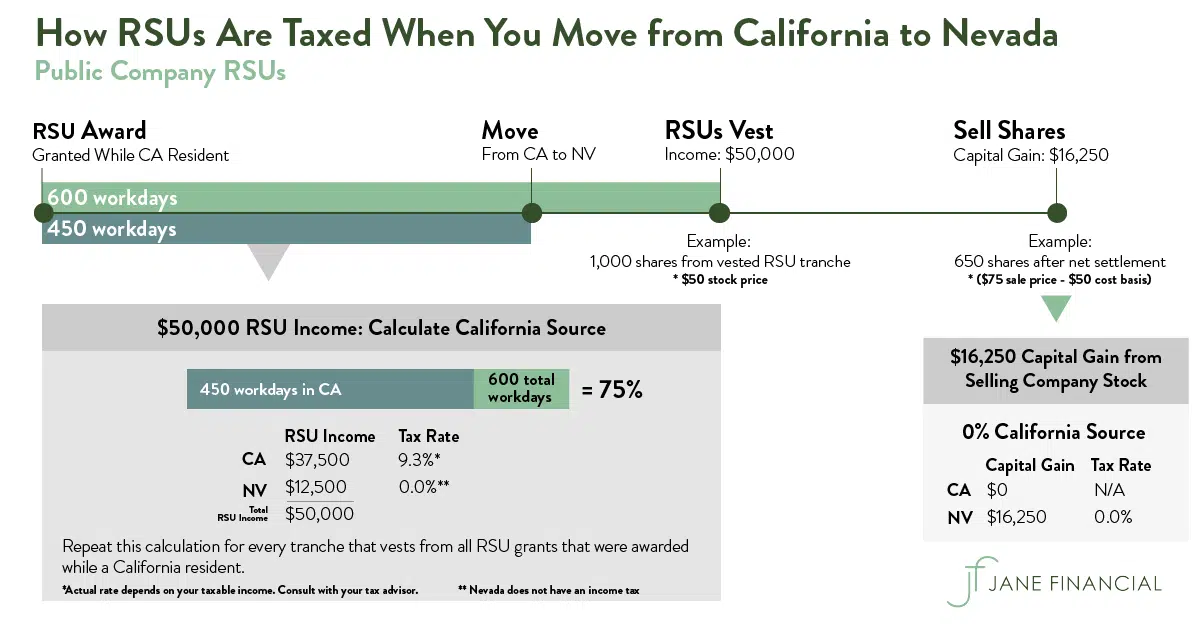

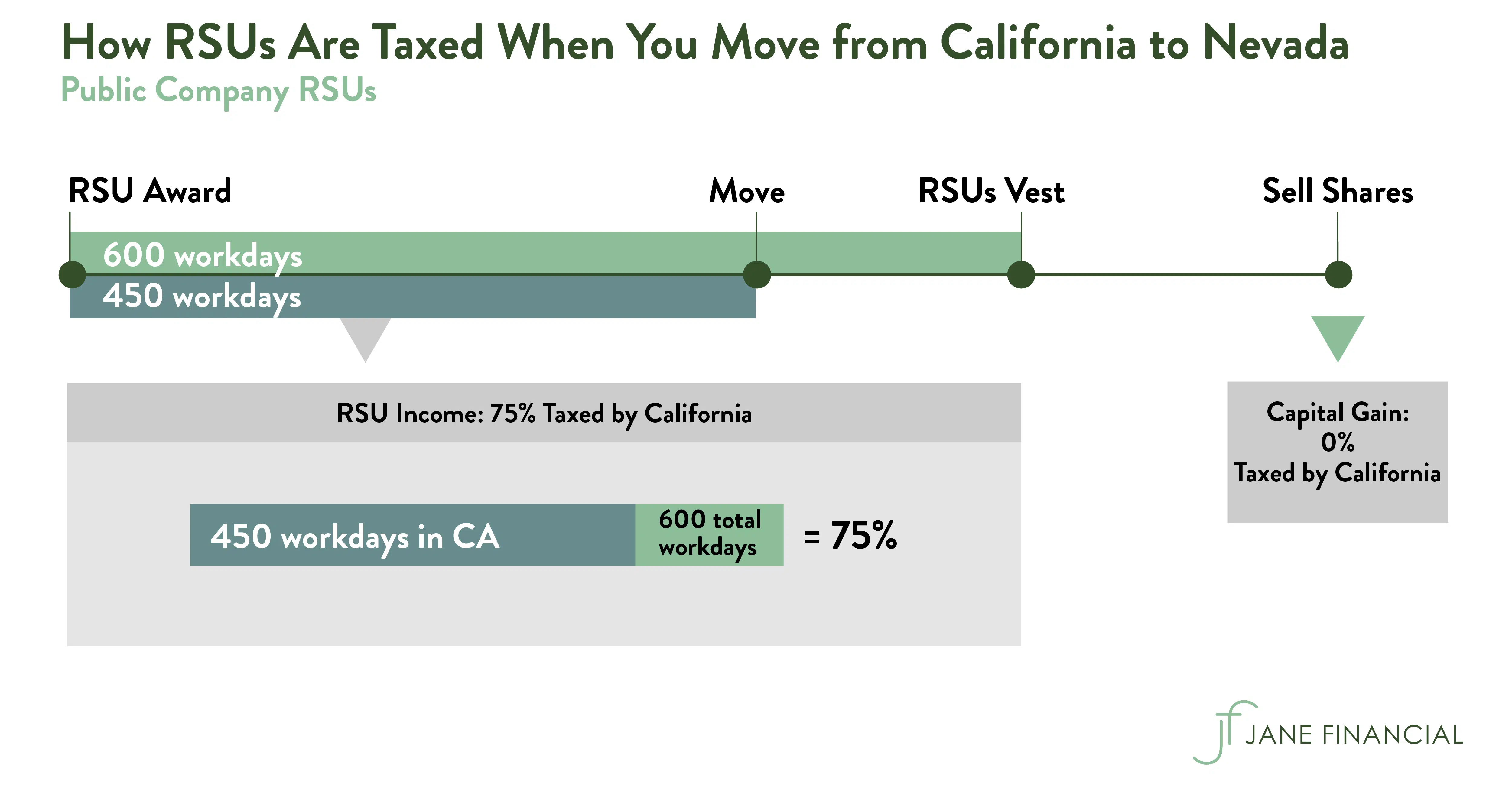

RSUs are taxed upon the delivery of shares which is generally upon vesting as income from employment at the progressive tax rate up to 495 percent. In Canada RSU plans are commonly referred to as phantom plans because under an RSU plan the employee initially receives notional units not shares. If you live in a state where you need to pay state.

Report under category 2 Shares of non-resident corporations other than foreign affiliates - Maximum cost amount during the year. A friend of mine told me they typically deduct the highest marginal tax rate 50 and so you. RSUs are taxed as W-2.

However the Canadian tax treatment of commonly granted equity compensation awards is very different than in the US. A flat rate of 22 is generally the rate of. For more information refer to Security options deduction for the disposition of shares of a Canadian-controlled private corporation Paragraph 110 1 d1.

23 days ago. This legal primer provides an overview of the tax. How Much Tax Do I Pay On Rsu.

The Section 83b election can save those with restricted stock quite a bit of money if they play their cards right but it can also be a bit of a gamble. RSUs serve as supplemental income in the same sense as the ordinary income of a person. Set to zero as I have no costACB due to.

How Do I Avoid Paying Taxes On Rsu. Some RSU receivers might opt to pay for the tax owed via personal check or would prefer the tax withhold via deduction of their paycheck. Taxes on businesses with revenues over 1 million will be 37.

Unlike the much more complicated ESPP they get taxed the same way as your income. RSUs can trigger capital gains tax but only if the. Section 83b Election.

The company holding the RSU sells about 54 which is the highest Federal rate max of all provincial rate currently NS at 21. Restricted stock and RSUs are taxed differently than other kinds of stock options such as statutory or non-statutory employee stock purchase plans ESPPs. RSUs are taxed at the ordinary income tax rate when they are issued to an employee after they vest and you own them.

Generally there is no. Sues second batch of 50 units of restricted stock vested on May 1 2012. Restricted stock and RSUs are taxed differently than other kinds of stock options such as statutory or non-statutory employee stock purchase plans ESPPs.

Please note that if your RSU income is taxed above 22 when. As a CDN tax resindet you will always be taxed with CDN tax rates. To avoid immediate taxation these types of awards.

The beauty of RSUs is in the simplicity of the way they get taxed.

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

Restricted Stock Units Jane Financial

Restricted Stock Units Jane Financial

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Restricted Stock Units Jane Financial

Paying Tax On Stock Options A Guide For Canadians By Stern Cohen

Restricted Stock Units Jane Financial

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Restricted Stock Units Jane Financial

Paying Tax On Stock Options A Guide For Canadians By Stern Cohen

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Rsu Taxes Explained 4 Tax Saving Strategies For 2021